Table of Contents

The best option for financing a DTF printer is opting for flexible installment plans. Seriously, it lets you jump in and start printing shirts right away, instead of waiting around until you’ve saved up the full amount.

When I first looked into buying a DTF printer myself, I quickly realized that the DTF machine was just the start. An A3 DTF printer needs an ongoing spend on dtf powder, ink, film, plus the whole setup.

I picked a pay-over-time option, and honestly, it changed everything. I didn’t have to sit on the sidelines for months—I got the printer, started dtf printing services right away, and my monthly payments basically paid for themselves through my DTF shirt printing jobs.

Option like Pay in 4 with zero interest, or installment plans that stretch out over two years, are perfect if you’re trying to get a DTF printer for a small business. You keep your cash free for other things, you don’t take a big risk, and your new DTF printer can start making you money from day one.

So, financing isn’t just a fallback—it’s actually a smart way to grow.

Understand Your Investment: What You’re Financing

Before you even start looking at financing, you’ve got to know what you’re really paying for. A DTF printer isn’t just a machine you buy and plug in—it’s a whole production setup. And honestly, this is where a lot of small businesses get tripped up. They focus on the printer and miss everything else they need.

From a Best DTF Printer for Small Business Perspective, You’re Financing:

● The printer (usually something like an A3 DTF model) for small batch production.

● DTF powder for adhesion

● Specialty inks, including white ink

● DTF transfer film,

● RIP software for color and ink control

● and usually a curing oven to lock everything in.

I’ve watched businesses run into trouble because they only financed the printer and forgot the rest. Suddenly, they’re dealing with delays, bad DTF prints, and extra costs right when they’re trying to get started.

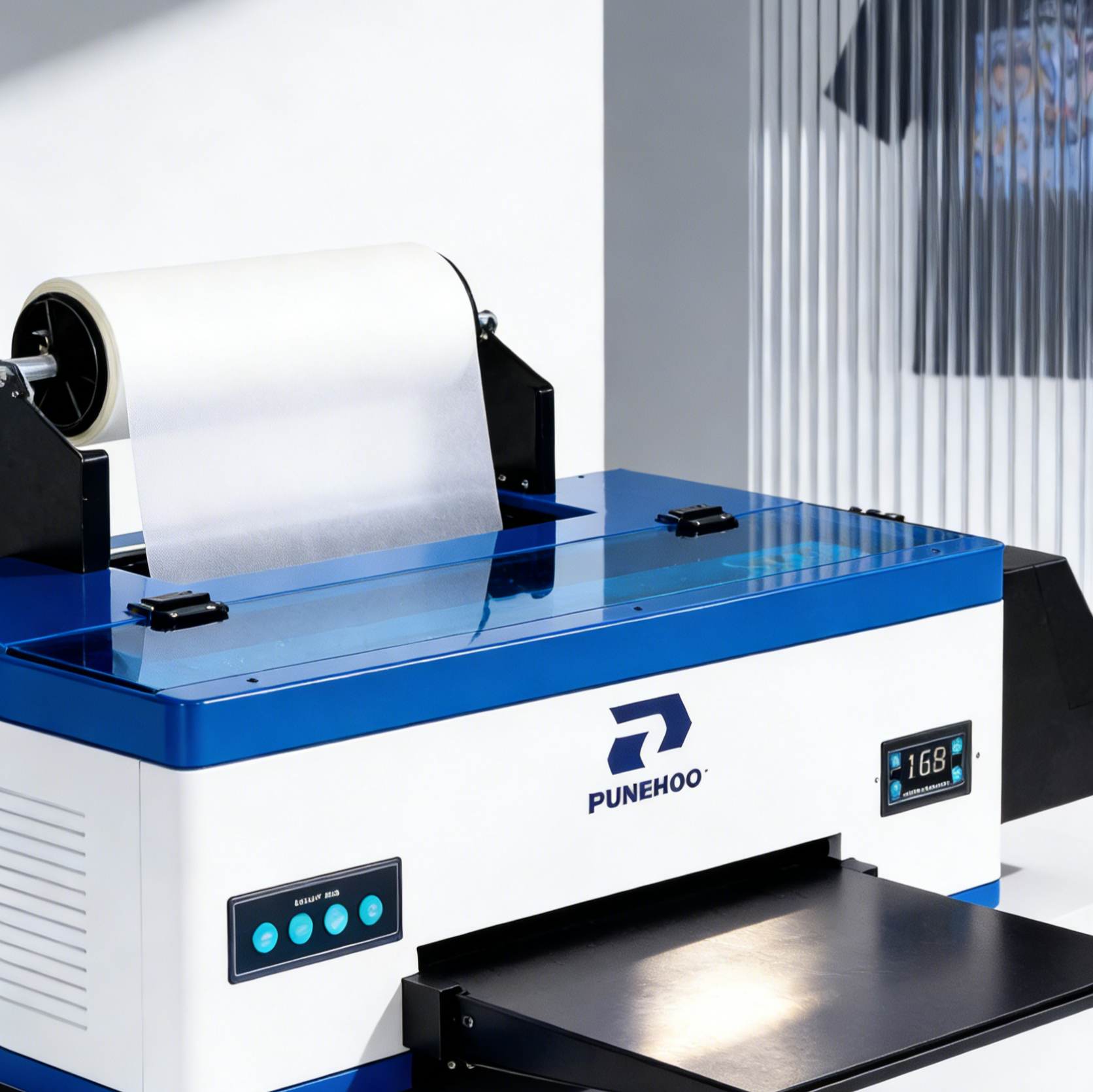

That’s why it makes sense to look at bundled packages. Take the Punehod R1390 A3 DTF printer package, for example. It comes with continuous roll feeding, a white-ink circulation system, an oven, inks, and film—pretty much everything you need, ready to go.

Instead of scrambling to buy missing parts later, you’re financing a setup that’s ready for production from day one. You can start offering DTF printing services right away, and you don’t have to worry about missing pieces when you want to grow.

In short, smart financing starts with knowing what’s actually included. You’re not just buying a printer—you’re investing in a full, revenue-ready DTF business.

DTF Printer Financing Methods — From Flexible Plans to Traditional Loans

Once you know exactly what you’re paying for, it’s time to figure out how you’ll actually buy your DTF printer. The best way to pay really depends on your cash flow, how fast you’re planning to grow, and whether you’re just getting started or already scaling up your dtf printing business.

Installment Payment Plans (Flexible & Business-Friendly)

Honestly, for most small and mid-sized print shops, installment plans are the easiest way to get your hands on a DTF printing machine or an A3 DTF printer.

Here’s how it goes:

● You pick your printer, check out, and instead of dropping a big chunk of cash all at once, you split the cost into monthly payments.

● You don’t have to wait around, either. As soon as you set up the plan, you can start printing and bringing in orders.

What does this look like in practice?

● Quick and simple checkout—usually with just a small upfront payment

● Fast approval right at checkout, no mountains of paperwork

● Pay in 4 chunks with zero interest, or spread it out further if that’s easier

● Plans can stretch up to 24 months, so you’re not feeling squeezed

The best part? Your payment schedule often lines up with the money coming in from dtf shirt printing, so you’re not stuck paying out of pocket before you’ve even made a sale.

Why do small businesses love this?

● You can start selling dtf transfers right away.

● Monthly payments often get covered by the orders you’re already fulfilling.

● Plus, installment plans are perfect if you want to see how the market responds before you go all in.

Most of the time, these plans show up right at checkout—often through services like Klarna or the store’s own financing option—so you can choose your payment method alongside credit cards or PayPal.

Equipment Financing & Small Business Loans

If you’re going bigger—maybe buying more than one DTF printer or setting up a full production line—equipment financing or a small business loan makes more sense.

Who’s this for?

● Shops buying multiple printers

● Full setups with heat presses, ovens, or other gear

● Businesses with steady, predictable orders

How does it work?

● You borrow the total amount you need upfront, then pay it back over a set period—usually anywhere from 12 to 60 months.

● Sometimes, you can even deduct the interest on your taxes, depending on where you’re located.

Why go this route?

● You own the printer outright

● It helps build your business credit

● Payments are predictable, so you can plan ahead

But there are some catches:

● You’ll go through a credit check

● Lenders might want collateral

● You’ll pay interest over time

Leasing vs. Buying

Leasing isn’t as common, but in some cases, it’s just the right move.

When does leasing make sense?

● You want to upgrade your equipment often as dtf technology changes

● You need to keep cash flow open, but you still have to produce

● You’re looking for lower monthly payments

What should you keep in mind?

● Leasing usually means lower monthly costs than a loan, but you probably won’t ever own the printer.

● Over the long run, leasing can end up costing more than buying, so weigh that before you sign anything.

Strategic Tips for Financing a DTF Printer Business

Getting financing for a DTF printer isn’t just about getting a yes from the bank—it’s about making sure the machine actually helps your business, not drags it down. You want a plan that ties your payments to your real workload, your actual growth, and how efficiently you run things.

● Line Up Your Payments With Steady Revenue, Not Wishful Thinking.

When you’re starting out with DTF shirt printing, set up your financing so regular orders easily cover your payment each month. That means picking an installment amount you can pay from your ongoing jobs, not just hoping future business will catch up.

If the machine is making money while you’re still paying it off, you keep your cash flow positive and avoid unnecessary stress.

● Grow At The Speed Your Market Can Handle.

If you’re new or just looking for the best DTF printer for a small business, stick with something like a single A3 DTF printer at first. This way, you can test demand, figure out your prices, and build up a client list without biting off more debt than you can chew.

Manageable payments give you breathing room, and when the orders really start rolling in, you can upgrade with confidence.

● Don’t Get Tripped Up By Hidden Costs.

A lot of people just finance the printer and forget about everything else. But a good setup includes the DTF powder, film, inks, and maintenance support.

Get a complete bundle—like the Punehod A3 L1800 package—so you’re not scrambling for missing pieces or losing money on downtime. That way, your financing turns into a business-ready investment from day one, not just a half-finished project.

Finally, the best financing keeps your DTF printer working, your cash flow strong, and your business growing in a way that actually makes sense.

Risks & Considerations

Financing makes it easier to get your hands on a DTF printer, but don’t get tunnel vision on those monthly payments. You’ve got to think about what you’re giving up, not just what you’re getting. If you spot the trade-offs early, you can dodge a lot of headaches later on.

● Interest Rates, Fees, And All That Fine Print Matter.

Even those “0% interest” deals love to hide a catch or two. Maybe there’s a fee if you’re late, or the low rate only lasts a few months before it jumps. So, before you sign up, dig into the repayment terms. Make sure those payments actually fit with how money flows in and out of your DTF business.

● Equipment Reliability Directly Affects Your Ability To Pay.

When you finance a DTF machine, uptime isn’t just nice to have—it’s everything. If your printer’s out of action, those monthly payments don’t stop just because your jobs do. Go for a machine that’s built to last, with solid support and easy-to-find parts. That way, you’re not stuck paying for something you can’t use.

● Don't Outspace Your Demand

Over-financing before you’ve got steady demand can kill your cash flow fast. It’s tempting to go big, but you’re usually better off starting with a single A3 DTF printer, running some shirt orders, and scaling up once you know the orders are there to back it up.

So, yeah—financing’s a great tool, but only if you match it with clear expectations, equipment you can count on, and real, proven demand.

Final Checklist Before You Finance Your DTF Machine

Before you jump into financing a DTF printer, take a breath and run through this quick checklist. Make sure the decision fits your cash flow right now—and sets you up for growth down the road.

First, get clear on what the “best DTF printer” actually means for your business. Not everyone needs the same thing. Figure out what matches your production volume, your standards for print quality, and how often you’re running orders. If your main thing is DTF shirt printing, pay extra attention here.

Next, weigh paying cash upfront against financing. Some suppliers knock a chunk off the price if you pay in full, but financing lets you keep more cash on hand. Go with whatever gives you the most value in the long run for your printing business.

Don’t forget about the stuff you’ll keep buying—DTF powder, inks, films, heat press gear. It all adds up. Make sure you’ve got these ongoing costs in your monthly budget, not just the cost of the printer.

And your financing plan? It needs to fit your real cash flow from direct-to-film orders, not just what you hope will happen. Financing should help you grow, not put you in a tight spot.

Bottom line: When your machine, supply costs, and payment plan all line up, your DTF printer becomes a solid way to make money—not a risk hanging over your head.